“How good is my Schufa score?” Would you like to know the answer to this question? No problem! Because what many do not know: The Schufa information can be requested online – and completely free of charge. We reveal how it works and what you need to look out for in the Schufa credit check.

TABLE OF CONTENTS

1-Apply for a Schufa self-disclosure free of charge

2-Free Schufa information: Required data

3-Schufa self-disclosure: You will receive this data

4-The catch: Schufa credit check

5-Schufa online: Self-disclosure is also possible digitally

Everyone in this country knows the credit agency Schufa Holding AG. Be it a new rental contract, a mobile phone contract or a loan – without a positive Schufa credit report, certain doors remain blocked or the admission price increases. Users often do not know their own Schufa score or the base score at all. We will tell you how you can view your personal data in the form of a Schufa report completely free of charge. However, as always, there is a small catch.

APPLY FOR A SCHUFA SELF-DISCLOSURE FREE OF CHARGE

According to Art. 15 of the General Data Protection Regulation (GDPR) , every citizen has the right to information from credit agencies, companies and authorities that store personal data. This also applies to the Schufa; that is why users can order a data copy with all their personal data on the meineSchufa.de portal. Cost point: 0 euros.

As soon as the free Schufa report has been requested, a printed copy of the data will be sent to the applicant by post. Of course, there is also a way to call up the current status online (also on mobile devices). However, Schufa only offers these and other services for a fee. The cheapest subscription model from meineSchufa called “meineSchufa compact” costs EUR 9.95 once (activation costs) and then EUR 3.95 per month. meineSchufa-Premium – and thus the most expensive variant – costs 6.95 euros per month. The scope of the package also includes a free Schufa credit report per year.

FREE SCHUFA INFORMATION: REQUIRED DATA

After you have started the ordering process for the data copy, you are immediately confronted with numerous input fields. Previous addresses, upload fields for the identity card, the passport and the registration certificate – all this data is initially NOT required for identity verification. As a rule, name, date of birth and address should be sufficient for identification to be carried out as part of the Schufa self-disclosure. Finally, Schufa sends the copy of the data by post. So if the registered address matches the actual address of the user, that should already be a protective measure against identity theftenough. If this is not the case, the remaining fields must be used. Estimated time required to apply for the free Schufa credit check: less than three minutes.

SCHUFA SELF-DISCLOSURE: YOU WILL RECEIVE THIS DATA

Basically, as the customer, you will receive a copy of the personal data stored by Schufa. In addition to banal details such as name and address, the information also includes information on the source of the data and who it was forwarded to in the past twelve months. The information sent as part of a credit check includes so-called probability values. By and large, these represent an assessment of your ability to pay – or the probability of a payment default. There is also the so-called base score. This is a kind of overriding value that is determined using mathematical-statistical methods and is given as a percentage (100 percent is the maximum).

THE CATCH: SCHUFA CREDIT CHECK

As a profit-oriented company, Schufa is geared towards generating income. That is why it offers private individuals the opportunity to request a credit report for just under 30 euros. But why should users spend money on information that they can also request for free? The answer is simple: the company displays all personal user data on the free Schufa report – including the exact Schufa score. This also includes confidential data that a landlord or employer, for example, does not necessarily have to have seen. As part of the Schufa credit report, on the other hand, only the information that is really necessary to indicate financial reliability ends up on the Schufa certificate.

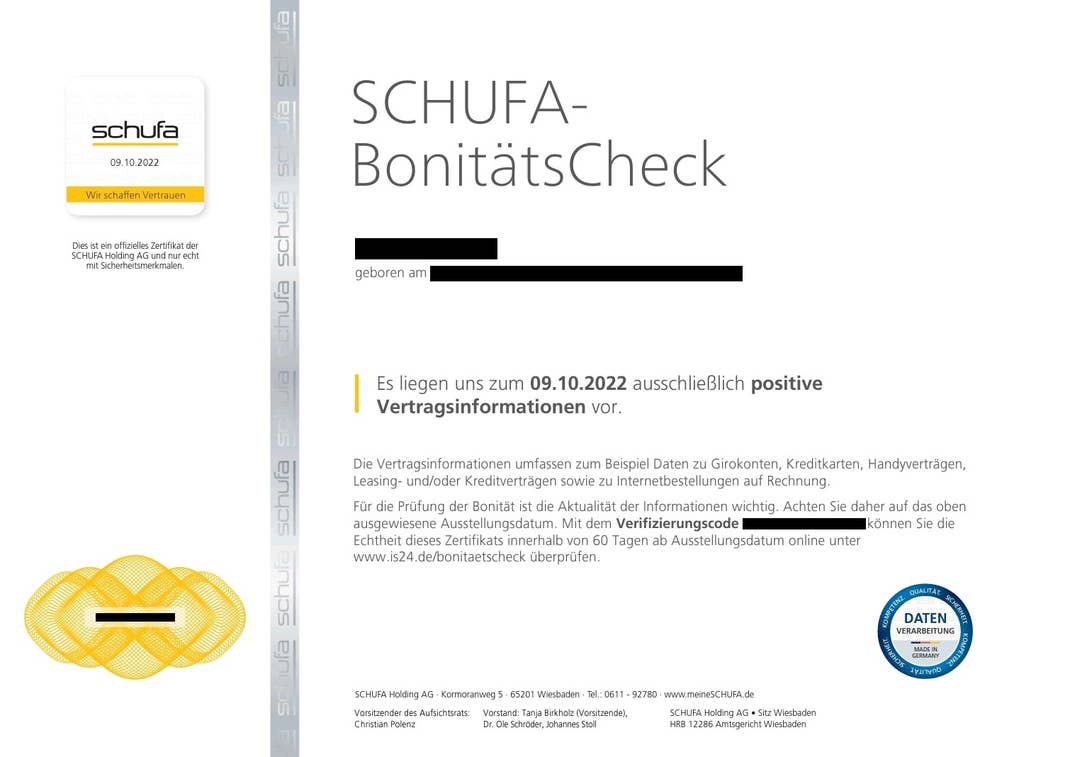

Specifically, the certificate of the Schufa credit check, which is equipped with a hologram strip and several seals, only includes general information about solvency in addition to the full name and address. If this is positive, the Schufa credit report says “Only positive contract information is available as of XX.XX.XXX”. If the information is negative, the verdict is as follows: “As of XX.XX.XXX we have information about payment disruptions. These can be relevant for a contract decision.”

SCHUFA ONLINE: SELF-DISCLOSURE IS ALSO POSSIBLE DIGITALLY

If you request a free self-assessment from Schufa, it will only be sent to you by post. However, this does not mean that you are denied an electronic copy of your personal data. Using your personal reference number (on the first page of the postal data copy) and a download code (on the last page of your data copy), you can also download a digital Schufa report from the following website . However, it should be noted that the download service is only available temporarily. In addition, the access data lose their validity as soon as the file has been downloaded. And for landlords, the Schufa credit report is generally better suited.